Explaining the Difference Between Stocks and Bonds

Bonds are usually less risky than stocks are but they also usually dont return as much. The bond market is where investors go to trade debt securities while the stock market is where investors trade equity securities through stock exchanges.

The Difference Between A Stock And A Bond Finance Investing Money Management Advice Investing

Stocks are risky and volatile but can provide high long-term returns.

. The difference between a bond and a stock. Potential benefits and risks of bonds. Created by Sal KhanWatch the next lesson.

A balance between the two types of funding must be achieved to ensure a proper capital structure for a business. The value of stocks fluctuate meaning at any point your original investment could be more or less than the stock is worth. The difference between stocks and bonds explained.

Stocks vs Bonds. Bonds meanwhile are effectively loans where the investor is the creditor. What is the difference between stocks and bonds.

Bonds offer both benefits and drawbacks for investors compared to stocks. What are the pros and cons for the issuer that issues stocks and bonds. Bonds tend to be low-risk and low-reward with.

Stocks Bonds It represents ownership in the company It is a form of long term borrowing by the company Stocks pay divid View the full answer Previous question Next question. Shares of common stock do not have maturity dates. Stocks and bonds differ in many important ways.

Stocks A stock represents ownership of the residual value or equity of. The basic differences between and stocks and bonds are explained in the following points. Stocks are considered riskier than.

Typically when thinking of investing we think of buying stocks andor bonds. The difference between stocks and bonds is as follows. Shares are issued by firms priced daily and listed on a stock exchange.

When stocks fall or when theyre in a bear market bonds tend to do OK. Stocks are more volatile than bonds meaning there typically is more risk but the returns are frequently greater. But with the potential of more return comes more risk.

If you choose to invest in a company there are two routes available to you equity also known as stocks or shares and debt also known as bonds. While bonds are issued by all types of entities including governments corporations nonprofit organizations etc. THE DIFFERENCE BETWEEN STOCKS AND BONDS.

Investment grade bonds or bonds that have a relatively low risk of default are usually considered safer investments. Stocks or shares of capital stock represent an ownership interest in a corporationEvery corporation has common stockSome corporations issue preferred stock in addition to its common stock. The financial asset which holds ownership rights issued by the company is known as Stocks.

Partnerships and corporations. Stocks on the other hand are issued by sole proprietors. As it turns out in periods where inflation is above 3 stocks and bonds tend to move in the same direction.

Stocks are equity instruments and can be considered as taking ownership of a company. If you own a stock you are a part owner of the business. For an ordinary investor stocks and bonds are both forms of investment as they earn money for him.

Stocks represent ownership in a company while bonds represent debt. In the books of the buyer stocks are carried as certificates of ownership while bonds do not involve ownership and are presented as certificates that oblige the buyers to pay back the agreed-upon rate of interest to the issuer at the end of the established period of time. Stocks are issued by companies whereas Bonds are issued by government institutions companies.

To sum up the level of risk and interest rate represents the main differences between stocks and bonds. Explain the differences between stocks and bonds. If stocks are going up bonds may not perform as well.

Stocks are an investment in a company and are very common in the financial world. Thats not always the case. If we look from the perspective of companies both stocks and bonds are instruments with which companies acquire funds for their operations.

A Beginners Guide to Stocks and Bonds Stocks vs. The difference between stocks and bonds is that stocks are shares in the ownership of a business while bonds are a form of debt that the issuing entity promises to repay at some point in the future. Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More.

If youre looking for the chance to earn a higher return youll probably want to consider stocks. Be sure to include how stocks and bonds are carried on the books of the issuer and then of the buyer. Here is a summary of the biggest differences between them.

Ad Put Your Investment Plans Into Action With Personalized Tools. More often than not bonds move in the opposite direction of stocks. These are issued by companies between common people to raise funds.

Bonds are the debt. Stocks provide the owner with voting rights in a. Open an Account Today.

Differences Between Stocks And Bonds Stocks And Bonds Investing Finance Investing

What Are The Differences Between Stocks And Bonds Stocks And Bonds Finance Investing Investing

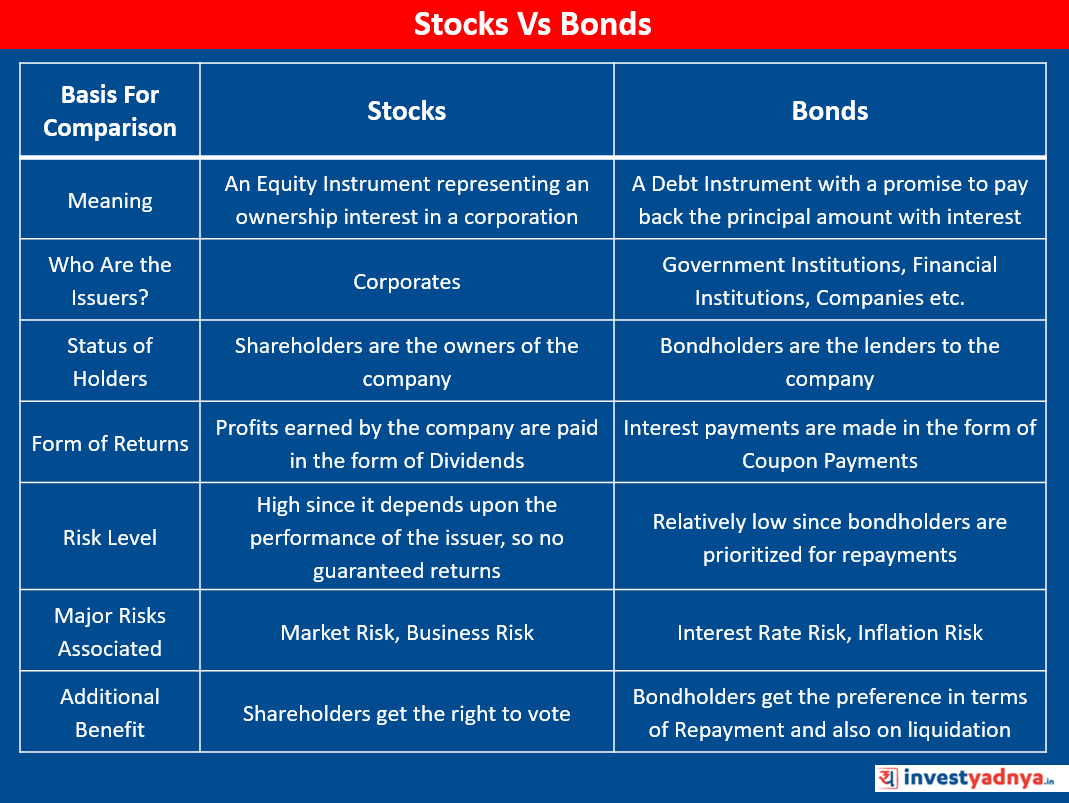

7 Points Comparison Of Stocks Vs Bonds Yadnya Investment Academy

No comments for "Explaining the Difference Between Stocks and Bonds"

Post a Comment