Total Depreciation Recorded Over an Asset's Service Life Is:

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance. Depreciation limits on business vehicles.

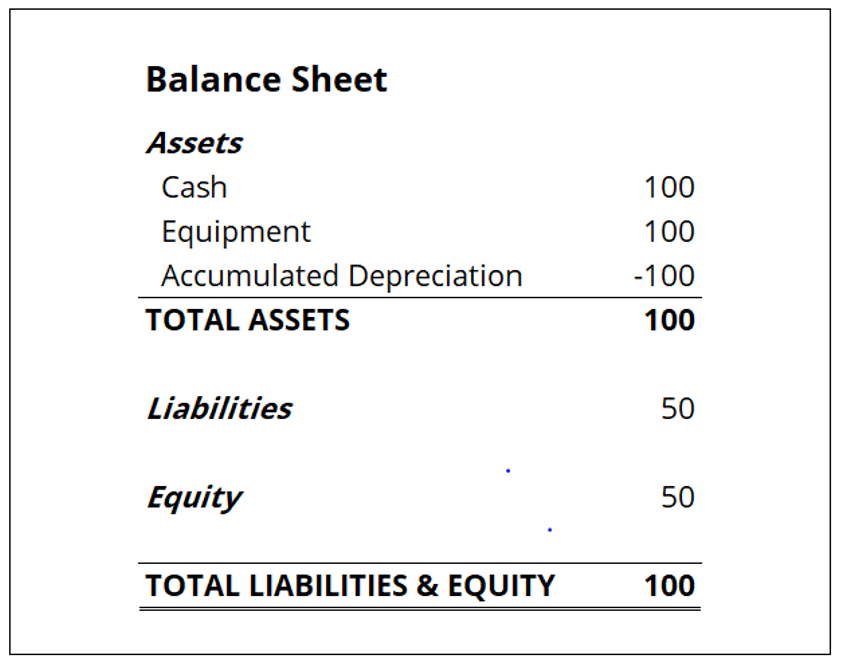

Depreciation Turns Capital Expenditures Into Expenses Over Time Income Statement Income Cost Accounting

Depreciation applies to expenses incurred for the purchase of assets with useful lives greater than one year.

. Erty placed in service after December 31 2021. A percentage of the purchase price is deducted over the course of the assets useful life.

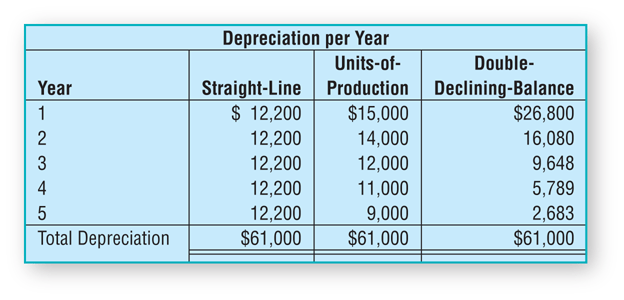

Depreciation Schedule Formula And Excel Calculator

No comments for "Total Depreciation Recorded Over an Asset's Service Life Is:"

Post a Comment